For decades, India has looked upon China as competitor in the economic sphere and rightly so. Indian civilization has historically been an economic superpower for centuries ahead of China. It was inevitable in contemporary economic history that a giant like China which is comparable to India in size and population was looked upon as an economic challenge while a failed state like Pakistan occupied mind-space as a military challenge. The frequent border clashes as well as terrorism emanating from Pakistan and the economic battle for higher growth and investments than China cemented the mindset. When China launched its reforms in 1978, its economy was just $10 billion bigger than India’s. The fact that Chinese economy is $10.9 trillion bigger than India today might weigh heavily in the minds of Indian economic and military strategists alike. The huge gap can be attributed to Chinese growth rate averaging 9.5 percent in the period compared to 5.8 percent for India.(Frost 2020) While the extent of damage to current Indian economy can be judged only when the Covid-19 crisis is behind us, it’s right time for a rethink of approach.

Starting in 1978 with the economic reforms, China under Deng Xiaoping had a first-mover advantage. After the Mao regime resulting in unnecessary deaths of estimated 80 million (estimates vary widely), the country was in chaos with Cultural Revolution. Being the first-mover compared to India, the learning curve was long for China due to lack of precedence. Deng Xiaoping’s policy statements and actions over the years reflect the practical approach of tinkering with different things to improve the performance of Chinese economy and raise living standards. (London School of Economics 2017)

The Chinese economy opened up starting 1978 while it took a crisis more than a decade later in 1991 when India would be left with no choice but to open up. In what would be radical departure from Mao, Deng explicitly said that some people should be allowed to get rich first.(Chorzempa 2018) The Indian political system without the baggage of Communism even today will fear to say or appear to be seen doing so. While explicitly saying or out rightly doing it will be shunned upon given the nature of democracy whether in India or USA, the Indian system hasn’t been conditioned with a free market economy even in three decades of liberalization, privatization and globalization. The public opinion still shuns privatization in key sectors and a chunk of voters negatively view the stake sale in PSU’s or privatization of some operations in Railways.

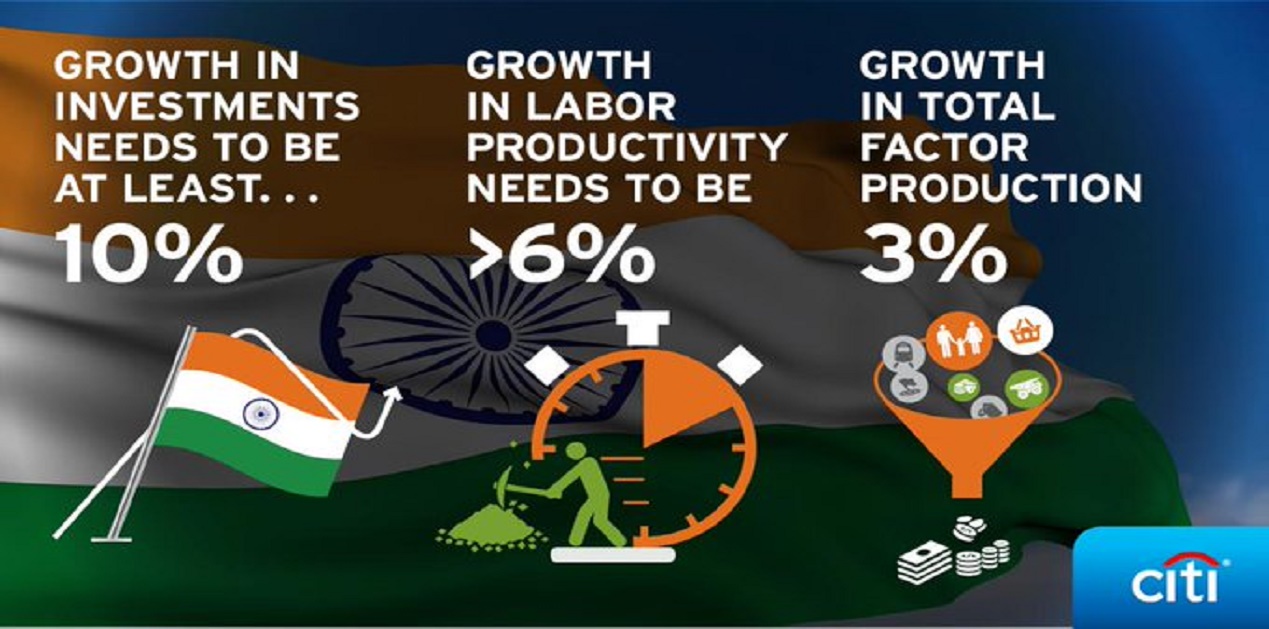

For a country like a China, it was a radical experiment in liberalization starting with Guangdong’s acceptance of foreign investment and special economic zones (SEZs) to facilitate exports. On one hand, the industry was opened up while on other hand rural reforms based on de-collectivization and liberation of households to produce for their consumption and sale were carried out. The first period of reform in 1978-83 saw growth of around 9% and continued at that rate for several years. Grain production meanwhile had grown to 400 million in 1984 from 300 million in 1977 and income of peasants doubled over this period in what was a sign of inclusiveness of growth with both peasants and industry benefitting. The experiment of Deng Xiaoping was rewarded by fate with “beginner’s luck” and continued thereafter. Even while investments grew over the next few decades, ‘total factor productivity’(TFP) was consistently above 3% for next 3 decades signaling a healthy growth rate and not just driven by foreign inflows or export driven. India has never achieved a consistent TFP growth for a reasonable period while China sustained it for much of the last 3 decades.(Chakraborty 2018) Investment and productivity is the key to the Indian growth story and China with a much bigger economy than India competes for investment due to the sheer size. Productivity benefits accrued to Chinese due to scale and experience in its way to being a manufacturing economic power that can’t be beaten easily either.

While China would undertake reforms which were radical for the times, Indian reforms in 1980s were more cautious until a crisis in 1990s accelerated the pace. The reforms like import liberalization, extension of export incentives and liberal access to credit and foreign exchange were the key steps during the 1980s. It would take another decade for sweeping pro-market reforms like i) abolition of industrial licensing ii) liberalization of FDI iii) Elimination of import licensing iv) liberalization of important sectors like telecommunication v) major financial sectors. (Kalpana Kocchar 2006)

It isn’t open to debate that more the investments for a given level of positive productivity, the more will be the growth and India was forever competing with China pitching the size, democratic credentials and promise. Even while western economies in theory believed the advantage of democracy in sustaining economic growth themselves being democratic, they chose their first-hand experience of lesser red tape and good return on investment (ROI) from China over India. The first mover China had by then the scale advantage and today is the biggest economy in the world in Purchasing Power Parity (PPP) terms. China can today position itself as a huge market comparable to USA while the Indian kitty won’t be seen as deserving the allocation which the giant Chinese economy can absorb. The fact that too-much focus on investments wasn’t working and a me-too India wasn’t attracting enough investments can be gauged from the statistics that only in 2018, Foreign Direct Investment (FDI) inflows pipped China for the first time in 20 years. The Me-too approach alone clearly didn’t work for 20 years and first-mover continues to have the edge.(Times 2018)

With reforms coming in a staggered manner, India was always playing catch-up for the prized investments which it was seeking to invite. In business parlance, India tried playing catch-up and became a me-too brand. A brand which positions itself in the marketplace without a ‘Unique Selling Proposition’ (USP) but against a well-entrenched brand with first mover advantage was always destined to grab only “leftovers” in terms of market share. India grabbed a small chunk as any other me-too brand grabs when the original brand didn’t appeal to a small section of users. A number of other factors prominently the currency manipulation by the Chinese contributed to competitiveness of China while Indian companies continued to remain insulated to competitive pressures due to higher taxes on foreign companies and similar advantages. As a democracy, it didn’t seem like a palatable idea to let Indian companies and foreign companies compete on an equal footing.

The question which begs the answer then is: What else if getting investments alone won’t suffice?

A Business which brands itself as an alternative and not as a substitute has higher chances of success to be a potent second player before reaching close enough in market share to topple the No.1 ranked. However nations aren’t businesses and a multipronged approach devoid of obsession with Investments would be the need of the hour. The current Covid-19 and the resulting decoupling of the western economies from China offers unique opportunity for India to regain a small part of the ground it lost over the decades. The suggestion in Economic Survey 2018-19 that India should use the disruptions caused by trade wars to “insert itself into global supply chains” should no doubt be carried to the hilt while chasing the $5 trillion dream. (Line 2019) Through aggressively pitching for investments while charting its own path in another domain and creating an expertise and reputation in it will bring in the addition to TFP as well as investments. The ruling Government to its credit is aggressively pushing the pitch for investments including several states making amends to laws to facilitate it while also marking land for the possible investors. The other domain where India should compete where scale and investments matter less is: Research.

While on one hand, India should continue competing with China for investments and get a bigger pie in a zero-sum game, there is the research domain where the game isn’t zero-sum.

Thomas Jefferson, the founding father and third US President wrote “That ideas should freely spread from one to another over the globe, for the moral and mutual instruction of man, and improvement of his condition, seems to have been peculiarly and benevolently designed by nature, when she made them, like fire, expansible over all space, without lessening their density at any point.”

India’s gain shouldn’t necessarily come from China’s loss as the last 3 decades experience shows that it didn’t work out that way. Economic growth can arise from people creating ideas. Ideas are nobody’s monopoly.

China can’t be sure of outwitting India in the ideas game with its scale if India gets it right. Deng himself believed that China needs large number of path breakers who dare to think, explore new ways and generate new ideas.(Lahiri 2018) Conventional wisdom therefore suggests a democracy is more suitable for economic growth unleashing the best minds to think and act free. India historically didn’t focus adequately on idea generation and research to fuel the growth.

In the 1995 treatise “R&D based models of Economic Growth”, Charles I. Jones argued against the “scale effects” of R&D spending. The proportional relationship between quantum of capital resources spent on R&D and its effect on per capita output growth doesn’t exist. Success in research depends on tinkering and a large number of people toying with ideas and not necessarily people better funded can change the dynamics. With approximately as much manpower as China, India can compete in getting the most research minds if not well-funded research. Big Data suggests that “every winner begins as a loser”. However the scientific realm progress is marked by successive attempts at tinkering learning and modifying from earlier experience. The key indicator of research success is that time between consecutive failed attempts should decrease steadily. In other words, more the number of attempts are made at research; more likely the success”. (Dashun Wang 2019)

The United States is seeing a slide in research productivity across all major industries despite increases in research efforts. Aggregate research productivity in US falls at an average rate of 5.30% every year implying a doubling of research effort every 13 years in order to maintain the same level of economic growth.(Nicholas Bloom 2020)

While China is ahead of India in research too, Indian Government should through careful cultivation of a research mindset fuel the growth without a need to rival but add to the knowledge data base in the world. The Western World with declining TFP will invest in Indian efforts for much more asymmetric returns on investments than home country. A series of successful inventions has the potential to change the growth trajectory of India completely than counting on investment-led or export-driven growth.

Indian society unlike the western culture shuns failure and research field is studded with grave failures and “learnings” which mark technological progress. Unless the basic risk aversion imbedded in Indian psyche is replaced with a system of rewards through a suitable ecosystem, India can’t provide the world which it desperately seeks – Ideas at cost-efficient prices and Economic Growth.

All India Research Excellence

The most important step to tap the student community and veer them to the path of research is academic rewards. The education system and its emphasis on rote learning is a matter of popular media and successive Indian governments have not been unaware of the same. Even with a series of government interventions to focus on ideas, the obsession of the Indian students and parents alike to the grades hasn’t been weaned off. The creative mind languishes with lack of recognition while the strong memory boasts of good grades which translate into better prospects for higher education and access to well-known centers of learning. The All India Ranking (AIR) is the coveted prize for the top performers in memory contest with no parallel means for the man of ideas to showcase his ideas. The competition, the resultant stress of students forcing extreme means even forced certain State Governments to move to grading system. However the goal post merely got shifted from absolute marks to securing straight A+ in all subjects.

The Introduction of All India Research Excellence (AIRE) ranking which would be a bigger status symbol than AIR for major competitive exams will skew the balance in favour of ideas away from rote learning. AIRE ranking which goes to select excellent students in research whose discovery/invention should be graded on the impact on area of study will pave way for a status symbol beyond the AIRs, IIMs and IITs. Rewards including waiver of exams for successfully patenting a product will not only ensure that emphasis on learning will continue rather than “uncertain” research. An average Engineering student would have the prospect of skipping all academic exams or do-away with mark-sheets altogether and receive the AIRE ranking which ranks above the AIR. The average parent while still emphasizing on memorizing to clear the exams will have an incentive to have their wards toy with ideas for the remote possibility of the coveted trophy.

Whether or not this idea will work, Indian education and outlook towards learning may drastically change with the introduction of AIRE rankings in entire higher-education system as a default parallel without need for specific enrollment. There are chances that students who are otherwise bright at memorizing may attempt to neglect academics (i.e. AIR) to shoot for the AIRE ranking secured only through patenting an idea and may end up without both. Research efforts whether in India or abroad are strewed with failures and the students will be no different. Chances are that Indian parents who invest heavily in success of their children unlike western economies may even invest in equipment’s from their pockets if educational institutions infrastructure is deemed unfit marking a radical change in attitude towards education. The successes of a miniscule number of students out of many intelligent students aiming for AIRE will more than make up for the failures. Chances are that most of the students who failed to make AIRE ranking by patenting something may have secured a broader perspective and education than just enough marks/grades to clear the academic year.

The recent step of Union government to launch “Accelerate Vigyan” by the Science and Engineering Research Board (SERB) is an excellent initiative. The Atal Innovation Mission promoting Atal Tinkering Labs should be actively engaged for creating an nurturing ecosystem of intelligent minds tinkering enthusiastically in the spirit of scientific advancements, noting their observations, improving their attempts to arrive at new ideas which can fuel growth. The current dispensation has introduced a slew of measures which needs to be continued and active engagement and interest in fostering a culture of research imbedded into the same. However, nothing can involve the largest numbers more than a parallel opportunity like AIRE within the existing education system for a student of ideas to beat their counterparts who have stronger memories. After all, memories are about prior experiences & second-hand knowledge-base while ideas can be unique.

Research

The Western world invests in research but faces diminishing returns on the research budget while Indian allocation to research is miniscule in comparison. An opportunity for win-win exists in research collaborations even though western economies would hesitate to transfer technology or know-how. Indian Government should make the first move by emphasizing and increasing budgetary allocation to research while also providing incentives for private sector to do so. What holds back the Indian government is probably the same reason private companies hold back – high failure rate. However, India should within the system and in private community increase recognition of the fact that one breakthrough out of numerous failures can more than cover up the economic costs just like business model of venture capital firms who invest in high risk startups. A higher proportion of Indian budgetary allocation should go towards high-risk high return investments while also continuing with infrastructure built up like roads and highways. An announcement of Rs.8000 crore in the last Union budget for a new national mission on quantum technologies is a right step for opening new frontiers in computing, communication and cyber security.

India had filed 14961 patent applications in 2017 while China filed 1.24 million. The competition in research domain can’t be reduced to mere numbers simply because quality matters. However, India has been scoring low in citations too which aren’t completely indicative of quality. It’s the race to discover the next big invention and not just the number game. India and China spent a similar portion of their GDP in R&D in 1996. While India in recent years spends less than 1% of GDP, China with a much larger economy spends 2.11% while South Korea spends 4.23%.(report 2019) Further, it also needs to be underlined that the proportion of investments is of less import than the quality of output. Just one invention the wheel saw mankind taking giant strides which millions of published papers and research put together can’t. Internet changed the world forever and connected mankind like nothing else before. It’s not about size of investments in research but about the impact although a bigger size increases the odds. China can’t necessarily beat the USA and replace their Top 10 Tech companies even with a bigger spend on research. Conversely, India can in theory beat the Chinese in research with a smaller budget relative to China. Israel stands out as a brand known for technology and impactful research with a much smaller size.

Apart from budgetary allocation and creation of physical research infrastructure, a dedicated team to invest time and efforts to build an ecosystem should be focused on. Vishwajeet Scheme of Central government has the potential to create disproportionate impact and more budgetary allocations and monitoring should go towards its implementation. Behavioral economists can play a key role in ensuring a structured system to enable such an ecosystem in the highest centers of learning while accreditation of educational institutions and privileges based on research activities will force the academic institutions to invest their bit in improving their rankings. A number of institutions sprouting up across the country doing independent research and patenting their output will provide necessary impetus to our GDP over the long term.

India is a country bustling with ideas and a democratic system has enabled an ecosystem of conflicting opinions to thrive. The need of the hour is to channelize the ideas so that on ground ‘jugaad’ in the face of lack of resources is replaced by serious research and innovation. An enterprising citizenry is sometimes less about technology itself and more about building a unique business model based on existing technology. At the end of the day, all new ideas with utility turned into commercial purposes adds on to GDP. The National Research Foundation shouldn’t be hesitant in associating with the best minds in the world even if it ends up with the decision-makers being non-Indians. After all India is a nation which has a tradition of openness to ideas right from ancient times evident from Rigveda that says “Let noble thoughts come to us from every side”.

By 2030, India will have the largest working age-population in the world. A generation which grew amidst an education system which also rewarded exceptional ideas and new research might be markedly different in quality than the era gone by. Indian economy should stop obsessing over the catch-up game and chart its own independent course while making the most out of the opportunities presented by current global economy.

(The paper is the author’s individual scholastic articulation. The author certifies that the article/paper is original in content, unpublished and it has not been submitted for publication/web upload elsewhere, and that the facts and figures quoted are duly referenced, as needed, and are believed to be correct). (The paper does not necessarily represent the organisational stance... More >>

Image Source: https://pbs.twimg.com/media/DYFCQljWkAAYXHn?format=jpg&name=small

Post new comment