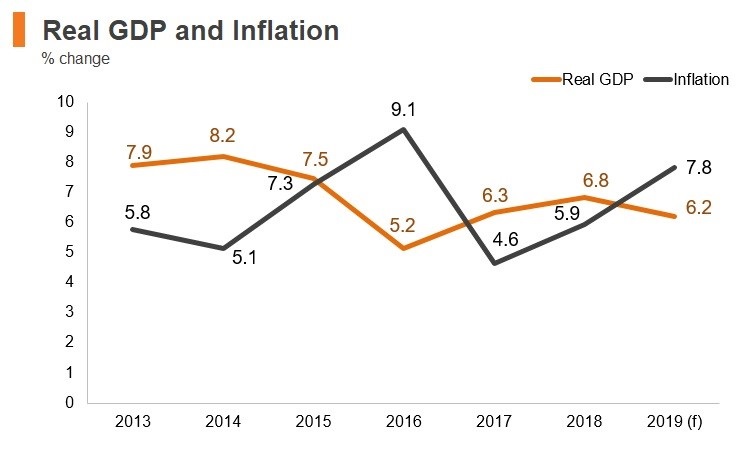

According to a recent World Bank Report (15 January 2020) the Myanmar economy is growing at a steady pace; it grew at 6.3 percent in 2018/2019 which is slightly higher compared to 6.2 percent growth in 2017-2018 and estimates for growth in 2019/2020 are pegged at 6.4 percent. This is one of the fastest rates of growth as compared to the rest of the ASEAN economies. There has been a revival of industrial activity helped by good performance in construction and garments industry. There has been some decline in inflation due to drop in fuel and food prices; as also the exchange rate has stabilized. Projections for 2020/21 forecast that the economic growth is likely to increase to 6.7 percent. All this is based on the premise that large infrastructure projects and Myanmar government’s economic reforms bolstered by investments in suitable sectors would drive the growth. Further, coming elections this year is also expected to motivate the government to invest more in infrastructure and other developmental projects that would sustain growth.

However, there are a number of endogenous and exogenous factors that could impact the positive growth trajectory of the economy. Deceleration of global economy and likelihood of economic sanctions by the US and European Union could have a negative impact on the positive momentum so far being achieved the Myanmar economy.

It is not only the global growth that has slowed down it is also the growth in the East Asia and Pacific region which is on the downward trend and has eased ‘from 6.3 percent in 2018 to 5.8 percent on average over the two years 2019-20, and is projected to decline further to 5.6 percent by 2021’.

There are also other negative factors like instability caused by ethnic strife, expanding Rakhine crisis and impact of the ongoing COVID-19 virus on tourist industry as also slowing down of work on the ongoing projects of China Myanmar Economic Corridor. According to thelatest reports some garment factories have closed down because of disruption/cutting down of supplies. One estimate puts a figure of over 120,000 labour becoming unemployed. Hopefully, this phase does not last long. Such factors would continue to pose downside risks for Myanmar’s economic progress.

Domestically, the NLD government has not been moving at the desired pace to usher in economic reforms which has retarded the pace of growth. The Myanmar government has, however, come out with a Myanmar Sustainable Development Plan (2018-2030) (MSDP) which undoubtedly is a very ambitious long term development vision for the country and is aligned with the UN’s 2030 Agenda for Sustainable Development. It lays down five goals for striving towards a peaceful, prosperous and democratic Myanmar. Broadly, these goals are peace and national reconciliation & good governance, economic stability, job creation and private sector led growth, human resources and social development and finally, development of natural resources & environment protection. While the MSDP does give out the priorities and likely strategies of the government concerning development and economic growth it is not very clear as to how the government would be able make a substantive progress on the goals enshrined in the MSDP.

Clearly, Myanmar government needs to raise resources for implementation of the MSDP however, the revenue from taxes is reported to be one of the lowest in South East Asia. The tax revenue of 7.9 percent of the GDP in 2018-19 is inadequate though its collections are on the upward path yet it would have to be raised much more through a slew of measures. Therefore, internal processes, mechanisms, tax laws and regulatory structures would need reforms and modernization; e-payments, e-platforms for a number of financial transactions would facilitate growth of tax revenue. Tax revenue to GDP ratio is said to be an average 15 percent across the ASEAN region.

However, according to a recent report in Myanmar Times (here) while the tax revenues are buoyant the government spending is lagging behind. U Maung Maung Win, Deputy Minister of Planning, Finance and Industry observed during the Hluttaw session on February 28 that

It is also noteworthy that Myanmar’s State Owned Enterprises (SOEs) provide over 50 percent of the tax revenues to the Government (e.g. the Myanmar Oil and Gas Enterprise Myanmar Gems Enterprise and Myanmar Timber Enterprise) while many remain non-performers and eat into the government’s revenues. Most lucrative of the SOEs also are under the control of Myanmar military. Therefore, a reform in functioning of SOEs is long overdue and most of them need to be privatized. There are many ills associated with the government run enterprises like inefficiencies, opaqueness, bureaucratic procedures and lack of proper governance and oversight. Reports also indicate that Myanmar military may not be very enthusiastic about reforms that would affect their cash flows from some of the rich SOEs where military has a major interest. Many international agencies and financial institutions have come out with reports and recommendations as to what ails Myanmar’s SOEs but on ground not much has been done to address the deficit in reforming the functioning of SOEs.

Undoubtedly, the private sector has a larger role to play in Myanmar’s economic growth and development. The MSDP rightly identifies it as a priority sector for expansion.

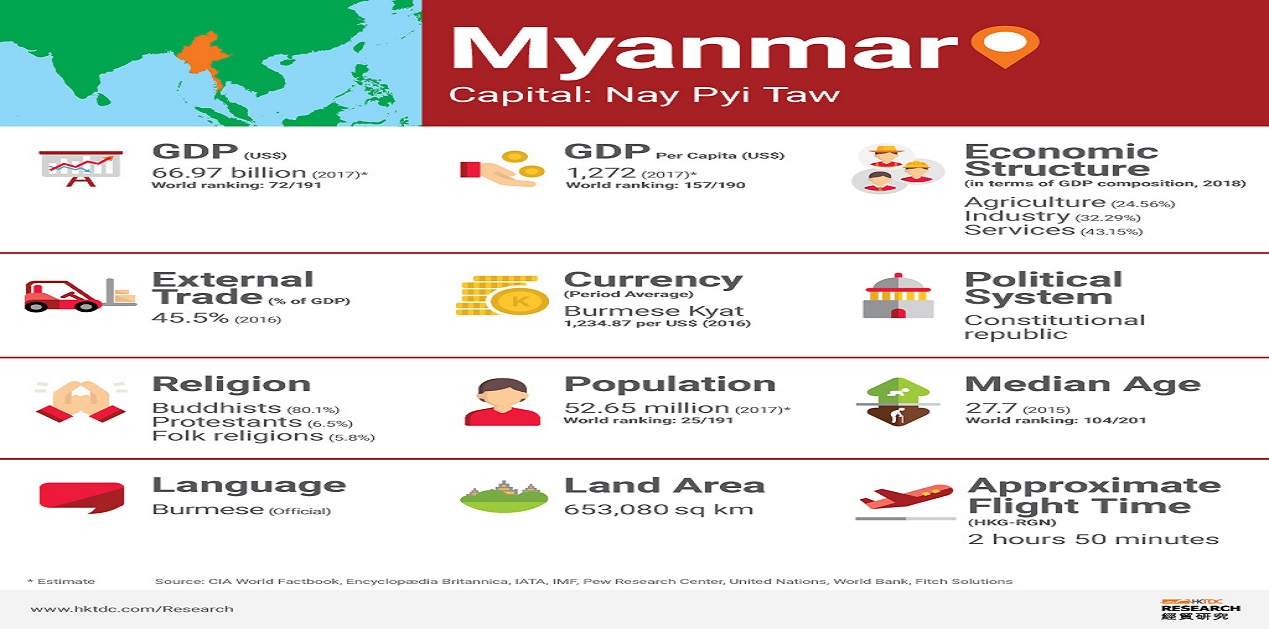

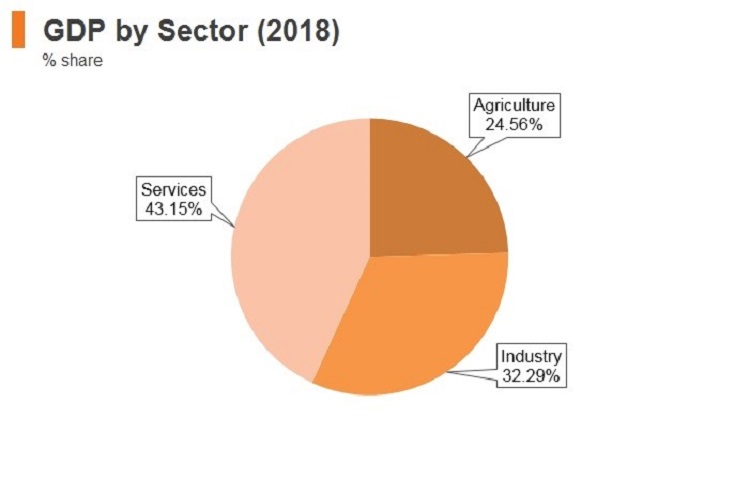

Over the last three years or so the structure of Myanmar’s economy has also undergone a change for the better. Contribution of agricultural sector to overall GDP of Myanmar was 42.9 % in 2016 which declined to 24.56 % in 2018; industrial/manufacturing’s contribution was 19.8% in 2016 which rose to 32.29 % in 2018 and the services sector also grew in the same period from 32.29 % to 43.15%. These figures reflect the contraction of agricultural sector and expansion of manufacturing and services sectors pointing towards modernization of Myanmar economy albeit at a slower pace.

On the other hand the agricultural sector still employs about 70 % work force which translates into fact that there is a large percentage of unskilled manpower which is not helpful for expanding secondary and tertiary sectors. Thus health, education and skilling the work force as also creation of jobs should continue to remain a priority for the government. However, this does not mean that agriculture should be neglected. Technology and best practices with adequate financing facilities would reap better results in the agricultural sector. Encouraging small and medium enterprises with financial incentives, modern technology, land and labour law reforms would be conducive for this sector’s growth.

India, in fact, has been supporting the development of SMEs (Small & Medium Enterprises) and agriculture sector in Myanmar as part of its Act East policy; last year in December, a Conference on India-Myanmar SME partnerships had been organized to promote bilateral cooperation. During Myanmar President U Win Myint’s visit to India in end February a number of bilateral agreements were signed in health, education and energy sectors for promoting Myanmar’s capability development. Conflict ridden Rakhine State of Myanmar was given special attention for some of these projects.

Overall, Myanmar economy has potential to grow at a faster rate due to its low base as also being rich in natural resources though it faces many challenges in its march towards becoming a tiger economy like some of the other South East Asian nations’ economies. And COVID-19 factor is yet to pan out as it is not only impacting China’s and South East Asian nations’ economies it has potential to disrupt the global growth.

(The paper is the author’s individual scholastic articulation. The author certifies that the article/paper is original in content, unpublished and it has not been submitted for publication/web upload elsewhere, and that the facts and figures quoted are duly referenced, as needed, and are believed to be correct). (The paper does not necessarily represent the organisational stance... More >>

Image Source: http://emerging-markets-research.hktdc.com/resources/MI_Portal/Article/mp/2013/03/456844/1566371067291_MMFactsheetEN_456844.jpg

Post new comment