On 21 February 2023, Prime Minister Narendra Modi and Prime Minister Lee Hsien Loong launched the first payment linkage between India’s Unified Payment Interface (UPI) and Singapore’s PayNow, which opened a new chapter in cross-border FinTech connectivity.[1] On this occasion, Governor of Reserve Bank of India (RBI), Shaktikanta Das and Managing Director of Monetary Authority of Singapore (MAS), Ravi Menon made live cross-border transactions to each other using their respective mobile phones. The UPI-PayNow linkage enables the people of the two countries to transfer remittances instantly, conveniently and securely by using their mobile phones. This marked a significant milestone in the development of infrastructure for cross-border payments between India and Singapore, which will strengthen economic and people-to-people ties between the two countries. It also marks an important milestone in the global expansion of UPI and provides an alternative to current SWIFT system to receive and make foreign payments. This closely aligns with the G20’s Digital Financial Inclusion priorities as it promotes the development of responsible innovative payment systems that provide affordable, secure, faster, transparent, and reduce remittance costs of cross-border payments.

The UPI, India’s fastest payment system which was launched in 2016, has emerged as the most popular and preferred payment system in India. It facilitates customers to make round the clock 24x7 for all 365 days of the year payments instantly, conveniently and securely using a Virtual Payment Address (VPA). It supports Person to Person (P2P) and Person to Merchant (P2M) payments as well as enables users to send or receive money, which accounts for 75 percent of total digital payments in India. The volume and value of UPI transactions has recorded phenomenal growth in recent years. While the number of UPI transactions increased from 0.45 crore in January 2017 to 804 crore in January 2023. The value has increased from just ₹1,700 crore to ₹12.98 lakh crore during the same period.[2] About 126 lakh crore rupees, which is more than 2 trillion Singapore dollars, transferred through more than 7400 crores UPI transactions in 2022. [3] This reflects the robustness of India’s digital payment ecosystem, trust and acceptance by both consumers and merchants. On the other hand, Singapore’s PayNow is the fast payment system which enables P2P and P2M payments through participating banks and Non-Bank Financial Institutions (NFIs) in Singapore. Like UPI, PayNow enables users to send and receive instantly funds from one bank or e-wallet account to another in Singapore by using their mobile number, Singapore National Registration Identity Card (NRIC), Foreign Identification Number (FIN), or VPA.[4]

The bilateral initiative to link their respective fast payment systems viz. UPI and PayNow began in September 2021, when the RBI and the MAS announced a project to link the UPI and PayNow with initially aiming to operationalize the project by July 2022. However, it got delayed and the people of the two countries have been eagerly waiting for this moment. Now, having bank accounts or e-wallets, they can transfer funds using just mobile number, the UPI-id, or VPA, the same ways as they do inside their respective countries. This linkage reduces paperwork and facilitates real-time, efficient, low cost and secure transfer of cross-border remittances from Singapore to India and vice-versa. Chief FinTech officer, MAS, Sopnendu Mohanty said that the implementation of this linkage will save at least 10 percent of the amount as bank fees for remittance transfer.[5] The linkage directly benefits common people and businesses of the two countries as it reduces the cost and inefficiencies in transferring money. The Indian diaspora in Singapore, especially migrant workers, professionals, students and their families will immensely benefit from this initiative. It is the outcome of extensive collaboration between RBI, MAS, and the two countries Payment System Operators viz. NPCI International Payments Limited (NIPL) and Banking Computer Services Pte Ltd. (BCS), in addition to participating banks or non-bank financial institution.[6]

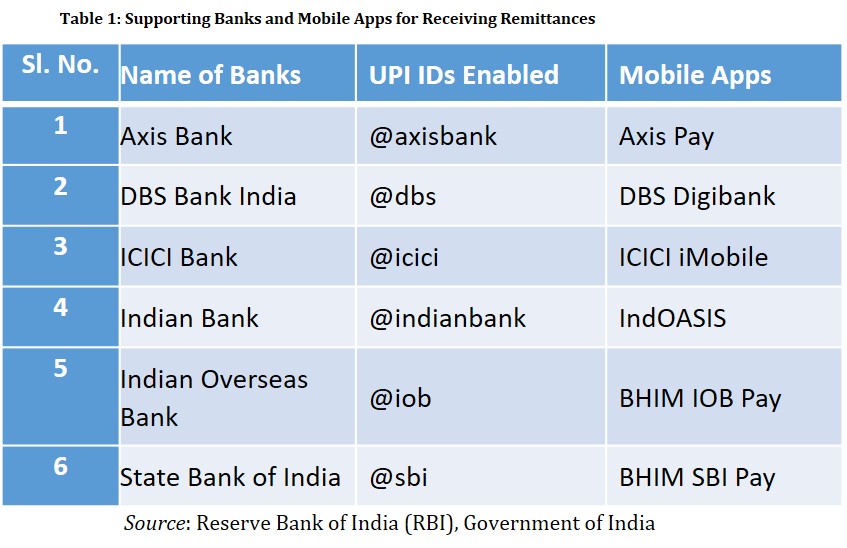

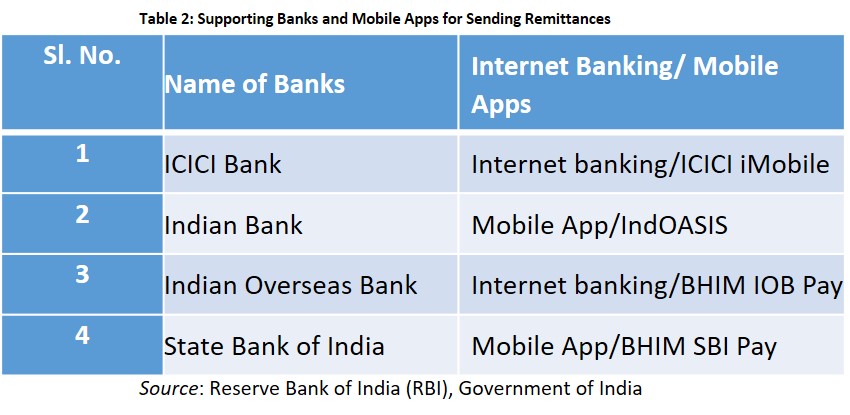

As of now, the ICICI Bank, Indian Bank, Indian Overseas Bank and State Bank of India facilitate both inward and outward remittances, while Axis Bank and DBS India facilitate inward remittances. For Singapore users, the service is available through DBS-Singapore and Liquid Group, a non-bank financial institution. In the coming days, more number of banks are expected to be included in the linkage. The RBI said that the customers of these banks can undertake cross-border remittances to Singapore using the bank’s internet banking or mobile banking app. At present, an Indian user can remit up to ₹60,000 in a day which is equivalent to around 1,000 Singapore dollar, and vice-versa.[7]

Singapore became the first country with which cross-border P2P payment system facility has been enabled. Though UPI enabled P2M payments through QR code is already available in select merchant outlets in Bhutan (July 2021), Nepal (February 2022), Singapore (March 2020) and United Arab Emirates (February 2022). The UPI payment services are expected to be available soon in the countries such as Australia, Canada, Indonesia, Mauritius, Qatar, Saudi Arabia, the UK and the USA. The UPI users of these countries will be able to make payments in foreign currencies directly. The RBI is in talks with these countries at various levels including through Central Bank to Central Bank and Network to Network arrangements for establishing direct UPI payment linkage. Recently, the RBI has enabled the visitors from G20 countries to be on-boarded to UPI payment without having a bank account in India. Through this initiative, the G20 visitors had a first-hand experience of making P2M payments using the UPI, during their stay in India.[8] It has also proposed to permit all incoming visitors to India to use UPI for their P2M payments, during their stay in India.

It is important to note that India received foreign inward remittances of $89,127 million in Financial Year (FY) 2021-22, which was the highest ever inward remittances received in a single year, of which India received 5.7 percent from Singapore i.e. $ 5,080 million.[9] Singapore ranked fourth largest country in terms of its share in inward remittances to India in FY 2021-22. In recent years, the Indians have moved from low-skilled employment in Gulf-countries such as Kuwait, Qatar and Saudi Arabia to high-skilled jobs in high-income countries such as Singapore, the UK and US. Given India has the largest diaspora in the world with over 32 million living outside, including 6.5 lakhs in Singapore,[10] inward remittances are expected to increase in coming years. For instance, the World Bank Report Migration and Development Brief November 2022 stated that remittances flows to India are expected to increase 12 percent to reach $100 billion in the year 2022. In this regard, a robust cross-border FinTech connectivity will be critical for two-way transfer of remittances instantly, conveniently, and cost-effectively.

In this context, a Symposium on Digital Innovations in Payments and Remittances was held in Hyderabad on 6 March 2023 on the side lines of the second meeting of the Global Partnership for Financial Inclusion (GPFI) under G20 India Presidency for both G20 and non-G20 member countries. The symposium led to a fruitful exchange of experiences and enhanced understanding on the fast development of a robust digital payment ecosystem.[11] The experts from India, including from the RBI, NPCI, and Ministry of Finance shared India’s experience on the role of digital financial ecosystem, rapid expansion of digital payments and transforming the financial inclusion landscape by leveraging Digital Public Infrastructure (DPI).

In the last few years, in fact, the Indian government has accorded the highest priority to create an enabling environment for innovation and modernization of financial system to reflect the fast-paced and constantly evolving nature of the digital economy. As a result, India has emerged as one of the fastest-growing ecosystems of FinTech innovation, which is led by thousands of start-ups in India. Because of the success of its FinTech innovation, India has emerged as one of the leading countries in the world in real-time digital financial transactions. It has created a highly secure, trusted, and efficient public digital infrastructure in its digital payments ecosystem as “a free public good”. Moreover, the Digital India (DI) mission, which was launched in 2015, has significantly developed India’s digital payment infrastructure. The DI campaign has also brought a number of reforms in governance and public service delivery.

These initiatives among others have improved the ease of doing business and ease of living in India. It has created unprecedented momentum to financial inclusion which reflects in terms of opening of over 460 million bank accounts under the Pradhan Mantri Jan Dhan Yojna (PMJDY) since 2014 along with growth of digital connectivity and payments.[12] This enabled the government to transfer money directly to the bank account of the crores of people in India during the global Covid-19 pandemic. Therefore, the digital payments are ensuring financial inclusion and empowering street vendors, small merchants and common people of India. Importantly, the benefits of UPI system are not limited to India only. The Indian government has offered this benefit to other countries and the UPI’s partnership with different countries is increasing. The Managing Director (MD) and Chief Executive Officer (CEO), NPCI, Dilip Asbe said that India is ready to offer UPI technologies and QR codes free of cost to other countries to help them build digital payment infrastructure.[13]

Therefore, the UPI-PayNow linkage has brought the benefits of digitalisation and FinTech to the common people of India and Singapore through instantaneous, secure and low-cost transfer of remittances. This will further strengthen India-Singapore economic and people-to-people ties in the years ahead. The success of this linkage will serve as a model for establishing similar cross-border payment infrastructures between India and other countries.

Endnotes

[1] “Prime Minister Narendra Modi and Prime Minister of Singapore Lee Hsien Loong participate in the Virtual Launch of UPI-PayNow Linkage between India and Singapore”, Press Information Bureau (PIB), Government of India (GoI), Delhi, 21 February 2023 at https://mea.gov.in/press-releases.htm?dtl/36278/Prime_Minister_Narendra_Modi_and_Prime_Minister_of_Singapore_Lee_Hsien_Loong_participate_in_the_Virtual_Launch_of_UPIPayNow_Linkage_between_India_and_. Last accessed on 9 March 2023

[2] “Address by Governor, Shri Shaktikanta Das, Reserve Bank of India - March 06, 2023 - Digital Payments Awareness Week (March 6-12, 2023) Launch of Mission ‘Har Payment Digital’, Mumbai”, RBI, GoI, 6 March 2023 at https://rbi.org.in/scripts/BS_SpeechesView.aspx?Id=1353. Last accessed on 9 March 2023

[3] “English Translation of Address by Prime Minister, Shri Narendra Modi at the Joint Virtual Launch of UPI-PayNow Linkage between India and Singapore”, PIB, GoI, Delhi, 21 February 2023 at https://mea.gov.in/Speeches-Statements.htm?dtl/36276/English_Translation_of_Address_by_Prime_Minister_Shri_Narendra_Modi_at_the_Joint_Virtual_Launch_of_UPIPayNow_Linkage_between_India_and_Singapore. Last accessed on 8 March 2023

[4] “India and Singapore to Link Their Fast Payment Systems – Unified Payments Interface and PayNow”, RBI, GoI, Delhi, 14 September 2021 at https://www.rbi.org.in/scripts/BS_PressReleaseDisplay.aspx?prid=52223

[5] “Singapore Residents Can Transfer Money to India through UPI from Today: What This Means”, The Times of India, 21 February 2023.

[6]NPCI (National Payments Corporation of India) is an umbrella organisation for operating retail payments and settlement systems in India. NPCI is an initiative of RBI and Indian Banks’ Association (IBA) under the provisions of the Payment and Settlement Systems Act 2007 for creating a robust payment and settlement infrastructure in India. And, see “Honorable Prime Ministers of India and Singapore Launch Real-time Payment Systems Linkage between the Two Countries”, RBI, GoI, Delhi, 21 February 2023 at https://www.rbi.org.in/Scripts/FAQView.aspx?Id=156. Accessed on 9 March 2023

[7]Ibid.

[8]Note. 2

[9] “India Received Highest Ever Foreign Inward Remittances in a Single Year of $89,127 million in FY 2021-22”, PIB, GoI, Delhi, 7 February 2023 at https://www.pib.gov.in/PressReleseDetail.aspx?PRID=1897036. Accessed on 10 March 2023

[10] “Population of Overseas Indians”, Ministry of External Affairs (MEA), GoI, Delhi at https://meacms.mea.gov.in/population-of-overseas-indians.htm. Last accessed on 13 March 2023

[11] “Roadmap Set for Important Deliverables on Digital Financial Inclusion, SME Finance”, PIB, GoI, Delhi, 7 March 2023 at https://pib.gov.in/PressReleasePage.aspx?PRID=1904865. Accessed on 13 March 2023

[12] “Pradhan Mantri Jan Dhan Yojana (PMJDY) - National Mission for Financial Inclusion, Completes Eight Years of Successful Implementation”, PIB, GoI, Delhi, 28 August 2022 at https://www.pib.gov.in/PressReleasePage.aspx?PRID=1854909. Accessed on 13 March 2023

[13] “UPI, Singapore's PayNow Integration Soon: Official at G20 Meet”, The Economic Times, 9 January 2023.

(The paper is the author’s individual scholastic articulation. The author certifies that the article/paper is original in content, unpublished and it has not been submitted for publication/web upload elsewhere, and that the facts and figures quoted are duly referenced, as needed, and are believed to be correct). (The paper does not necessarily represent the organisational stance... More >>

Image Source: https://img.jagranjosh.com/images/2023/February/2122023/india-singapore-moi.webp

Post new comment