US President Harry Truman entangled in an array of economic views had famously asked for a “one-armed economist”.[1] A team of economists pronouncing “On the one hand, this” and “On the other hand, that” may have seemed too confusing for a former army colonel like him. The military was apparently a less ambiguous battlefield than the economic Marshall plan which Truman implemented. Interestingly, it’s not just Truman who sighs with conflicting perspectives – it’s the financial markets and media too.

On 18th August, 2022, the RBI released its monthly Bulletin which included six articles one of which was titled “Privatisation of Public Sector Banks: An Alternate Perspective”. [2] As the title indicated, it put forth the alternative view on Public Sector Bank (PSBs) akin to saying “On the other hand, this”.

The highlights can be rephrased as:-

On one hand, public sector banks are not as efficient as private ones in profit maximization.

On other hand, PSBs have done better in promoting financial inclusion.[3]

On one hand, it is argued that staff at PSBs are inefficient.[4]

On the other hand, labour cost efficiency is higher in PSB’s compared to private.

On one hand, lending by PSB’s is less pro-cyclical

On other hand, this action of PSBs helps counter-cyclical policy actions to gain traction.

The essence is that while RBI bulletin didn’t rebut the arguments in favour of privatization, it brought to light that certain social good is served by these very sub-optimum condition and actions of PSBs. What was sub-optimal from point of view of profits was good when viewed from prism of economy as a whole. What was regarded as ineffective by shareholders would be deemed as positive by the society. It helps that a huge chunk of shareholding of PSBs was by the government itself which represents the society.

The alternate perspective true to its title brilliantly highlighted the positives which PSB’s serve in the economy. It concluded that while conventional perspective backs privatization as a panacea for all ills, the economic thinking has evolved into a realization that a more nuanced approach is required while pursuing the same.[5] However, the nuances of the argument were lost on the markets when reports emerged that RBI was against privatization. The RBI promptly issued a clarification next day stating that it’s the work of researchers and do not represent the RBI’s views. It further emphasized that “A big bang approach of privatization may do more harm than good.” and clarified that its gradual approach is in line with announcement by the Government in this regard.[6] It was important for the economy that RBI clears misperceptions about not being on the same page as the Government. RBI to its credit did that promptly and cleared the air. The RBI Governor went one step ahead and said in an interview that “the central bank is neutral with respect to ownership of banks. The RBI is agnostic to ownership structure.”[7]

The Tug of war between development view and performance view in Banking

The tug of war between development view and performance view in banking isn’t a recent one. The only difference in recent times is that the tug of both ideas competes in a more equal footing or at least comparable footing. It’s a closer contest than brute dominance of development view of yesteryears when big bang nationalization of banks was done as if profitability, sustainability or private ownership of banks was a taboo. Independent India when formally adopting a mixed economy by trying to ward off both capitalist and socialist forces in the international stage was tilted towards the latter. For every activity based on the attitude that development of economy should be the goal of a bank, the performance of individual banks has been a tradeoff. In the initial decades of Indian independence, development view had a brute dominance not just in banking sector but in overall economy. The Soviet Union planning commission model combined with preference for state-owned factors of production dominated the Indian psyche. Post-Independence India preferred mediocre state-owned enterprises than the prospect of private owned firms for private profits. The development view became entrenched in banking also because performance and profit maximization of firms for equity holders was secondary because the government itself was the major shareholder.

The Reserve Bank of India wasn’t entirely public sector. Independent India nationalized it in 1948. Within the first decade of Indian Independence, the government created State Bank of India (SBI) by nationalizing Imperial Bank and merging several State-owned and State-associated banks into it. By 1959, one-third of the then banking assets was in public sector banks. It was the nationalization of 14 banks in 1969 and another 6 banks in 1980 which ensured that 90 per cent of the Indian banking system’s deposits and loan became public sector.[8] The tug of war was overwhelmingly towards the idea that banks are essentially instruments for development and that wealth-creation through efficient allocation of resources was secondary. Expansion of bank branches and lending to priority sectors was purported to be the means to achieve development and the economists with performance view had to meekly surrender.

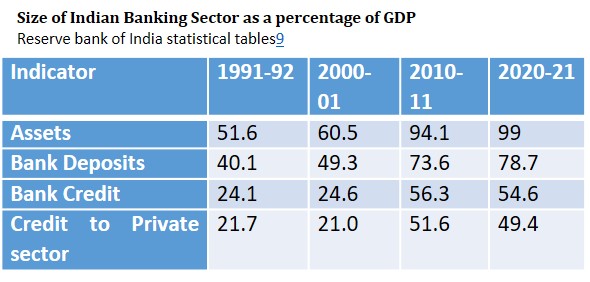

The first minor victory for the performance view was pulled by the economic forces in 1990. The opening of unviable bank branches came under dark clouds and policy makers had a serious rethink about the strategy. The bank-branch-expansion programme was formally discontinued in 1990. The priority sector lending norms first adopted in 1985 into the banking system was questioned for the first time. The Narasimham Committee I in 1991 even recommended phasing out of PSLs. While PSLs haven’t been phased out even three decades down the line as development view still dominates discussion on PSLs, the Indian economy reaped rich dividends as banking sector grew post liberalization after private banks joined the fray.

Bank credit as a percentage of GDP still remains low compared to other countries in 2020-21 despite major achievements over past three decades. Compared to 55 per cent in India, rest of the world is at 99 per cent while countries like Vietnam at 148 per cent and China with 182 per cent dominates the charts.[10]

With the increasing strength of performance view in policy circles and resulting privatization, the shadow of development view still looms large despite private sector clocking impressive statistics over last few decades. The bank credit figures are after considering that Statutory Liquidity ratio (SLR) of 23 per cent and Cash Reserve Ratio of 4.5 per cent. By performance viewers, the SLR of 23 per cent is still considered high which restricts the scope of lending. Apart from these reserves which choke up capital, Priority sector lending of about 40 per cent further restricts bank’s ability to lend by restricting avenues for lending activity to defined priority areas set by regulator. The proponents of development view may contend and rightly so that larger economic purpose like food self-sufficiency is best served because of agriculture being a priority sector. They may make their claim stronger by pointing out that despite regulatory priority, Public Sector Banks (PSBs) have shown more consistency in allocating larger portion of credit to agriculture than private banks. The private ones may have nitpicked and shrewdly targeted personal loans and similar categories within PSL which are more attractive from a profitability motive. In short, the tug of war between performance view and development view still dominates within the confines of regulatory nitty-gritty and laws giving a performance edge to private banks while making PSBs more of instrument of state policy and greater good vehicle. Given a choice between acquisition of 1 high net worth individual (HNI) and 1000 farmers in a backward region, a private bank will always invest and prioritize towards acquiring the HNI customer than 1000 farmers with low income levels. The PSBs with development view may not perform well in acquiring and serving the HNI individual with high service expectations but may serve the 1000 farmers who in turn may grow 500 tonnes of food grains which thousands of HNIs can consume. The ripple effect on the economy due to such phenomena is hard to measure. If PSBs act more like private banks with their new found autonomy after disinvestment which they will, what if the rural economy is starved off credit as capital moves to optimal location? What would be its impact on rural sector and its indirect impact on agricultural production and what would be the cost taxpayers will pay because of shortfall? What if faster migration of rural populace resulted in lowering of labour costs in urban area due to increased supply and increased social unrest?

Unsurprisingly, there seems to be no credible undercurrent of school of thought which calls for immediate & complete privatization and unanimity exists that a big bang approach in the medium term would do more harm than good. Being a witness to a slew of bank bailouts by the USA after the great recession a decade ago may be the plausible reason why no economist calls for radical privatization today. The most extreme in the performance view is dominated by the idea that every PSB should be privatized except for State Bank of India which should remain under government ownership for the time being.[11] In my view, privatization of every PSB except SBI would lead to concentration of systemic risks which are otherwise spread over a number of PSBs with differing risk profile, asset structures and varying geographical presence. During the 2008 financial crisis, a movement of depositors to PSBs and smaller decline in market valuations was seen in PSBs which was attributed to a perception of implicit guarantee on deposits held by them.[12] Specifically, the tendency to favour healthier banks and banks with more stable funding didn’t wholly explain the movement of deposits to SBI. It appeared that the factor responsible was “the implicit government guarantee of the liabilities of the country's largest public bank dominated other considerations.”[13]

By privatizing every PSB except State Bank of India, the systemic risk would get concentrated in case of next financial crisis as depositors move more aggressively to the lone bank which appears to have this implicit government guarantee. The presence of a Punjab National Bank, Union Bank of India, Bank of Baroda, Canara Bank, Bank of India etc. alongside SBI will widen the pool of banks with perception of implicit government guarantees. The debate on how many PSBs are optimal for a healthy economy and developmental goals should have an answer which isn’t singular. Considerations should be made about existing asset base, risk profile & geographical areas to select PSBs for value in developing the economy through financial inclusion and other means. The government policy of consolidating the PSBs is aimed at ultimately privatizing 8 PSBs which leaves 4 PSBs still under government including the behemoth SBI. While the strategy seems sound, the statistics suggesting that all PSBs except SBI are losing deposits and assets very fast isn’t good news. [14] If government intends to retain a handful of PSBs apart from SBI, the declining market share of PSBs is a cause for worry because economic forces may ultimately make SBI-the lone PSB.

The golden mean between the two extremes still remains elusive and many statistical and even philosophical questions needs answer. Can policy initiative be taken to ensure NBFC’s do most of the heavy lifting towards financial inclusion with better efficiency than PSBs? At what point does focus on financial inclusion goal become detrimental due to diminishing marginal returns? How much investment in financial inclusion is appropriate in areas with very backward regions with less income levels? Can that money be more productively used in raising income levels? How can technology help inclusion in a low-cost operating model to make banking cost-effective even in backward regions? Or even more radical ideas like “Is financial inclusion overrated?” considering that no-frills account (PMJDY) already have reached mass levels are questions without easy answers. What complicates discussion is that many technological means are available today to chase developmental goals without compromising on profitability or disinvestment.

The current reality of government intending to retain 4 Public Sector Banks will be overwhelmed by economic forces if the tendency to prefer State Bank of India dominates. The customers moving money to SBI may result in significant weakening of the other PSBs in the long term. If other PSBs keep losing customer patronage, government patronage alone won’t count for much and SBI will end up as the only PSB purely due to market forces. In short, what seems plausible over the next few decades is 1 PSB namely State Bank of India and a number of private players. The factor which may accelerate this trend is technological. Private Banks have displayed greater dynamism in offering banking solutions while PSBs are seen as lagging behind. Cybercrimes are rising in the banking system and private players are better positioned to hire talent to tackle that. A startup ecosystem is booming in India but with very less participation by PSBs. UPI payments have become part of everyday life. The irrational exuberance on crypto-currency is waning while CBDC launch by central banks across the world is in the offing. RBI has already launched its CBDC in December 2022. Fintech firms will chip into the market share of PSBs across various verticals. The increasing adoption of emerging technologies like artificial intelligence (AI), machine learning, data analytics and blockchain will enable fintech players to expand their range of offerings and provide better experience. The private players are flexible to attract talent immediately, acquire technology or even co-opt the fintech players through mergers and acquisition. Banks across the world are gearing up for the upcoming decade where the nature of their operations would resemble a tech company rather than a financial institution. They are hiring big time and competing with IT companies in attracting talent.

Bankers will require technological skill-sets as much as financial and regulatory knowledge. Currency notes itself will be printed less because Central Bank Digital currency (CBDC) may take its place. With collection, disbursement and withdrawal of physical cash becoming less relevant, the importance of bank branch and ATM will wane and will be perceived as cost centre than as a profit centre. Customer touch points will not be as much about experience inside the branch but about User Interface (UI) Design and User Experience (UX). Private Banks would be deemed as best one for service while PSB especially SBI would be perceived as best for safety.

To ensure that other PSBs continue to thrive, government should emphasize technological skills and initiative among the staff to adapt to ever changing world of banking. What we need is a more balanced distribution of risks than putting all eggs in one basket and risking a too-big-to-fail bank. In the first 25 years after Independence, we erred by focussing too much on developmental side and ended up nationalizing most of the banks. We were forced by economic factors to retract within next 25 years. We did that and reaped the benefits of subscribing to performance and viability view when private banks competed with PSBs. At the end of third 25-year cycle i.e. in 2022, we are at a point where Private players have a proven track-record and ideas like privatize every PSB except SBI don’t seem too radical anymore. As a democracy, we must account for the fact that all it takes for public opinion and expert view to shift is one economic crisis and a few bank failures. Once the narrative shifts, it won’t be surprising if calls for nationalization again get preeminence within next few decades.

The experience of capitalist country like America during GFC in 2008 when excessive risk-taking resulted in a crisis which necessitated tax payer funded bailout needs to be kept in mind. If India ends up in a similar situation in the long run, there would be enough experts who will cry hoarse that rather than privatizing profits and socializing losses, the best course would have been to retain most of the PSBs so that both profits and losses are nationalized. Everyone sounds wiser with the benefit of hindsight. The prevailing wisdom of our times suggest that default of bank loans by big industrialists and the resulting NPA’s are a result of connections in corridors of power which influence government owned PSBs in disbursal of loans. The perception isn’t without merit. However, it should be remembered going back into history that when banks were being nationalized, then government stated in parliament that purpose was to “sever the link” between banks and industrial groups to whom they give credit.[15] Rather than being swayed by the trend of our times, a more moderate approach is the need of the hour to arrive at best solution.

Seeing from the prism of need for moderation and taking into account the positive impact of PSBs as pointed out by RBI, the government plan and avoidance of big bang approach seems like the best course amidst the elusive golden mean. The former RBI governor Duvvuri Subbarao pointed out that privatization will manifest in two ways - First, overall efficiency of the banking system will go up since PSBs will also become profit oriented; second, some social objectives maybe compromised.[16] The trillion dollar question in a country like ours with glaring inequalities is how the compromised social objectives will manifest itself in the economy. Do we need to swing to the other extreme at a juncture when India has around 53000 branches at about one branch serving 12 odd villages.[17] The private banks with 7500 branches in rural villages still have a lot of catching up to do. The newly privatized PSBs would target profitability by aggressively closing unviable branches. The unavailability of bank branch in vicinity may affect many schemes targeted at rural poor under direct benefit transfer. For a day labourer, the cost and time to go to a bank branch in distant town will also be a factor or even an impediment.

Let’s not be too enamoured by capitalism and push the pendulum to the other extreme end. Economic inequality is a reality in every country whether developing world or advanced economies and may remain an unavoidable part of Indian growth story too. The nuance of the RBI bulletin with alternative perspective was to caution against going overboard with prevailing sentiments and statistics because both sentiments and stats may change a few decades from now.

The speculation about privatization again gained credence this year as media reports claimed existence of a list of PSBs set for privatization. On 6th Jan, 2023, Niti Aayog refuted the claims and informed that no such list has been shared. [18] The RBI through last years’ report successfully sparked a healthy discussion by bringing the alternative view on performance of PSBs. Media speculations aside, RBI successfully initiated a more nuanced discussion while also highlighting to stakeholders that it’s not a simple pro-privatization or anti-privatization debate but a real dilemma. A one-armed economist required by Harry Truman simply doesn’t exist. It’s actually a pursuit of the golden mean which will work best for Indian economy at the current phase of development.

Endnotes :

[1]https://www.economist.com/buttonwoods-notebook/2010/06/07/one-armed-economists

[2]https://rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=54225

[3]https://rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=54225

[4]https://www.rbi.org.in/Scripts/BS_ViewBulletin.aspx?Id=21205 Gupta & Panagariya 2022

[5]https://www.rbi.org.in/Scripts/BS_ViewBulletin.aspx?Id=21205

[6]https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=54230

[7]https://www.timesnownews.com/business-economy/industry/rbis-stance-on-ownership-is-neutral-governor-shaktikanta-das-on-privatisation-of-public-banks-article-93732036

[8]https://www.moneycontrol.com/news/opinion/bank-privatisation-forget-big-bang-its-unlikely-there-will-be-even-a-whimper-9077491.html

[9]Reserve bank of India statistical tableshttps://dbie.rbi.org.in/DBIE/dbie.rbi?site=publications#!4

[10]RBI data for India and WDI data for other countries

[11]Poonam Gupta & Arvind Panagariya 2002 (Privatization of Public Sector Banks in India. Why? How & How far?)

[12]Acharya 2012

[13]Eichengreen and Gupta 2013

[14]https://theprint.in/economy/in-just-5-years-private-banks-have-narrowed-public-sectors-huge-lead-in-loans-deposits/550570/

[15]https://thewire.in/banking/public-sector-banks-privatisation-reservation-taxes

[16]https://www.moneycontrol.com/news/business/banks/privatisation-may-make-banks-more-efficient-but-will-compromise-on-social-objectives-says-former-rbi-governor-d-subbarao-9109291.html

[17]https://www.financialexpress.com/industry/banking-finance/53-years-of-bank-nationalisation-time-to-bid-adieu-to-public-sector-banks/2598289/

[18]https://www.hindustantimes.com/india-news/niti-aayog-refutes-media-claims-on-list-of-psbs-set-for-privatisation-101672996840482.html

(The paper is the author’s individual scholastic articulation. The author certifies that the article/paper is original in content, unpublished and it has not been submitted for publication/web upload elsewhere, and that the facts and figures quoted are duly referenced, as needed, and are believed to be correct). (The paper does not necessarily represent the organisational stance... More >>

Image Source: https://imgk.timesnownews.com/story/p2-19.jpg?tr=w-600,h-450,fo-auto

Post new comment