The United States of America has decided to roll back the waivers on its sanctions on entities or countries engaged in oil trade with the Islamic Republic of Iran. The waivers known as Significant Reduction Exemption (SRE) expired on 2 May 2019. Non-renewal of SRE was aimed to ensure that Iran’s primary source of income is cut-off by making its oil exports plummet to zero.

After the US imposed sanctions on Iran’s oil exports, oil prices leapt to a six month high by 1.1 per cent, with prices setting at US$ 66.30.1 It is not just the action taken on Iran by the US under President Donald Trump which has led to this leap in oil prices, the situation in Venezuela and Organisation of Petroleum Exporting Countries’ (OPEC) insistence on reducing output have put pressure on prices and could lead to oil prices continuing to surge. While various ways have been devised by India to mitigate the effects of sanctions on Iran’s oil exports, it has looked at alternative oil suppliers to meet her vast consumption.

Why are oil prices high?

On 14 July 2015, Iran and the US, along with China, Russia, the UK, France, Germany and the High Representative of the European Union for Foreign Affairs and Security Policy signed the Joint Comprehensive Plan of Action (JCPOA) to make certain that Iran maintains a peaceful nuclear programme. The agreement accommodated mutually determined parameters for enrichment and research and development activities which led to comprehensive lifting of all UN Security Council, multilateral and national sanctions pertaining to the nuclear programme and opened up access to trade, technology, finance and energy.2

On 8 May 2018, the Trump administration announced its decision to withdraw from the JCPOA. The US imposed unilateral sanctions and has continuously engaged with Iran’s customers to cut down their imports while also putting more pressure on OPEC, especially Saudi Arabia to hike oil production. Relations between US and Iran have soured to the point where the Bureau of Counter-terrorism in the US State Department put Iran’s elite Islamic Revolutionary Guard Corps (IRGC) in the Designated Foreign Terrorist Organisations list on 15 April 2019.3 In response, Iranian Consultative Assembly on 16 April 2019 voted to declare the US Central Command as a terrorist organization.4

In the present context, resolution between the two states seems improbable with the US trying to choke Iran off its most significant source of income in order to force it to renegotiate a new nuclear deal. As a consequence of non-renewal of waivers and designation of the IRGC as an international terror outfit, the Islamic Republic has threatened to block the flow of trade through Iranian waters in the strategic Strait of Hormuz. 5

Iran, after a year of facing continuous unilateral sanctions, with no room for negotiations, on 8 May 2019 has announced its decision to partially withdraw from the JCPOA.6 Resultingly, it would not abide by limitations on stockpiling excess enriched uranium and heavy water reserves.7 The JCPOA, in a nutshell, made Iran promise to rein-in its civil nuclear programme which the western states have for years suspected to be a front for a nuclear weapons programme. The deal was made in such a way that while Iran reduces its uranium enrichment, based on International Atomic Energy Agency (IAEA) inspections, its economy would be put back on track by slowly removing sanctions placed on it. The present situation in the West Asian region is highly volatile as the US has deployed USS Abraham Lincoln Carrier Strike Group and B-52 bomber force in the Strait of Hormuz to warn the Islamic Republic that it is ready for escalation.8

The new developments in the region are not the only reason for the oil prices to soar, the situation in Venezuela, especially the state-controlled Petróleos de Venezuela, S.A. (PDVSA) is in dire need of an overhaul. PDVSA in its heyday pumped more than 3 million barrels of oil with the figure now almost half and dropping because of years of negligence, mismanagement, and graft. Sanctions by the Trump administration have made things worse for the PDVSA as it has constricted Venezuela’s ability to access US financial markets. With hyper-inflation being rampant in Venezuela, a significant amount of PDVSA’s ancillary staff has left the country to seek new opportunities in North America or the West Asian region, especially Saudi Arabia, which has impacted the production and the running of the state-owned company.9

Venezuela intends to utilise its cryptocurrency, ‘Petro’ as a mode of transaction in oil trade and has offered a discount of 30 per cent. However, this process is of little help to India and China that have effectively banned any transaction via crypto-currencies because of its volatility. India on 28 May 2018 turned down the offer from Venezuela.10 The hyper-inflation along with the exodus of professional staff and volatile political climate has pushed Venezuela to the brink despite its huge oil reserves. The dire situation of PDVSA has led to oil prices being volatile and the economy has become highly unsustainable.

How will India cope up?

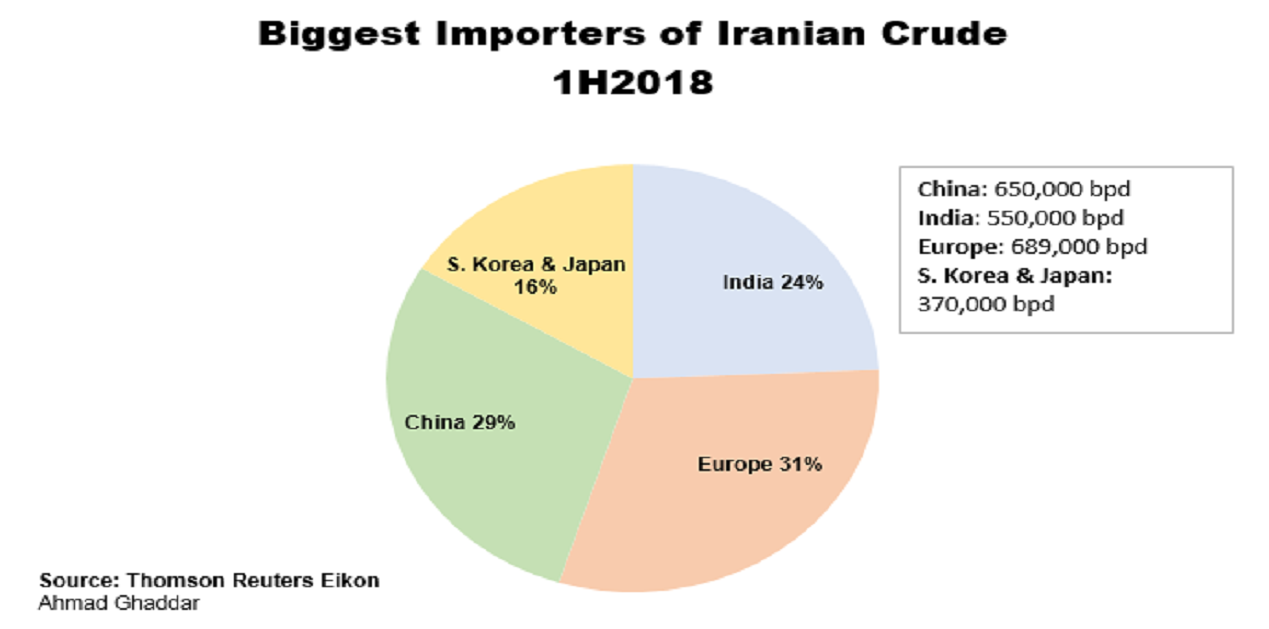

The reaction from India has not been welcoming but China has been more vocal about its displeasure of the non-renewal of SRE. The Chinese Foreign Ministry made it clear that they do not recognise the unilateral sanctions posed by the US on Iran and calling for the US to respect cooperation between China and Iran which “is open, transparent, lawful and legitimate”. China, through its statements, seems determined to continue its imports from Iran not paying any heed to warnings of sanctions issued by the Trump administration.11 Unilateral sanctions by the US are suspected to be more severe compared to 2012, when output by Iran fell by 1.2 million barrels a day. Iranian exports after sanctions are supposed to stabilise at 800,000 barrels a day, but the worst case scenario would be 600,000 barrels a day.12

While China seems to be more inclined towards defying US sanctions on Iran, India, on the other hand, is not willing to go that far and is well prepared to offset the imports by focusing on additional suppliers of oil. In the last five years, Iran has steadily risen to be India’s third largest supplier of oil, complimented by bargains like higher discounts, longer credit periods and better insurance and shipping deals which has made Iran a reliable supplier of oil.13 While Saudi Arabia has been a reliable supplier of oil, but their control over OPEC swings the prices which affects India’s balance of payments. Aramco, the Saudi state-owned petroleum company, is bidding to acquire stakes in the Jamnagar oil refinery, the world’s largest. 14 Saudi Crown Prince Mohammad bin Salman is more than determined to make Aramco public by the end of 2020 or early 2021 with the IPO valued at US$ 2 trillion. While the IPO has been planned since 2016, its delay is also affecting the Crown Prince’s “Vision 2030” plans for Saudi Arabia as it will help get US$ 100 billion to help recognise the plans which promise to transform the Saudi economy and lessen its reliance on oil money.15

After the SRE was rescinded, the Iranian Foreign Affairs Minister, Javad Zarif visited India on 13 May 2019 and held meetings with the then Minister of External Affairs, Sushma Swaraj. The meeting at the time seemed inconclusive as elections were taking place in India, and indicated that any decision regarding future imports would be taken once the new government is elected.16 An official from the Ministry of External Affairs (MEA) said that any future transactions (payment process) would have to be recommended by the Iranians, and would be only relevant after the elections. Furthermore, it may not be possible for India to secure its energy needs from Iran as the shipping system, banking and insurance would remain under the ambit of sanctioned items. Any decision on India-Iran relations, seen from Indian perspective, prioritises energy security, economic interests, and commercial considerations.17

The situation in the region worsened after Saudi Arabia said that two its oil tankers were sabotaged off United Arab Emirate’s coast on 12 May 2019, with the US extending a warning to ships that “Iran and its proxies” might target maritime traffic flowing through the region.18 The U.S also accused Iran of attacking oil tankers near the Gulf of Oman on 13 June 2019 leading to the US sending 1,000 additional troops.19 Military tensions between both states escalated after Iran shot down a US military drone on 20 June 2019.

The escalating situation in the region puts India in a tough spot as it not only loses its cheap energy source but also stalls the development plans for the Chabahar Port which was to connect India to Afghanistan and the Central Asian and help open an alternative route, rather than relying on Pakistan.20 An Iranian official was also reported saying that Iran’s exports have halved oil exports to 1 million barrels per day and is expected to go down to as low as 500,000 barrels per day. The Iranian demand to remain in the JCPOA is to export a minimum of 1.5 million barrels per day during their talks with the European Union in May 2019.21

Despite the volatile oil prices and the political decisions behind it, the US in the last five years has become one of India’s top crude oil supplier, providing 2.75 per cent (11,768 thousand barrels by April 2019) of its total oil requirements.22 MEA’s reaction compared to the Chinese reaction was more poised as round-the-clock negotiations are taking place between representatives from the US and India, which will help secure India’s energy and economic security.23

Conclusion

The European Union members, especially France, Germany and the UK have failed to deliver an alternative trade mechanism called the ‘Instrument in Support of Trade Exchanges’ (INSTEX) which was supposed to bypass the ‘Society for Worldwide Interbank Financial Telecommunication’ (SWIFT) and enable high-value cross border transfer among its members. Russia is also working on a transaction system called ‘System For Transfer of Financial Messages’ (SPFS) as an alternative to SWIFT which has been in the works since 2014. The Russian leadership is confident that the system is credible and benefits Russian businesses and banks in case of sanctions which might put them at risk. 24 The western perception of what is termed as ‘Project Double Eagle’ is that while the system might work for the Russian domestic markets and some non-western markets but it is not enough to deal with western partners.

Since 2014, Russia has been trying to push for SPFS and Mir Payment System, with negotiations being underway with Eurasian Economic Union and the BRICS while agreements are likely to be signed soon with China. Turkey and Iran then would enable these states to access the proposed SWIFT alternative. The push by Russia is aimed at creating a standard payment system which would be almost out of global jurisdiction of Office of Foreign Assets Control (OFAC) of the US Department of Treasury, but it lacks the functions and operations of SWIFT.25 International financial institutions in Central Asia are not able to connect to the SPFS when incidentally it is in these countries that Russian banks have significant transactions. The shortcomings of SPFS, coupled with almost no action on INSTEX makes it difficult for them to be considered as viable alternatives to SWIFT.26

In December 2018, India and Iran agreed on a payment mechanism which would overcome the sanctions by the US. Payments for oil imports from Iran would be kept in escrow accounts of five Iranian banks which would be managed by India’s UCO bank. The payment mechanism includes Iran using a part of the deposits for purchasing essential goods and expenditures incurred by the personnel of Iran’s missions in India. Iran will also use the payment mechanism to import goods from food to medicines and also draw money from the accounts held by UCO bank, which would cover the cost of maintaining Iranian missions in India; all transactions would be conducted in Indian Rupees.27

In March 2018 it was reported that India was considering a Rupee Payment system for its trade with Venezuela. Private refiners like Reliance Energy and Nayara Energy import around 300,000 barrels per day from Venezuela and the government has cautioned the private players to avoid any payment system controlled by the US. The payment mechanism proposed would be the same as that is being used for Iran. India barely imports more than 1 per cent of its crude oil needs from Venezuela, and even if the payment mechanism is approved, the sales proceed will be unused because of the trade imbalance between India and Venezuela in favour of the latter. Venezuelan imports from India have fallen because of a major financial crisis and political instability in the country.28

The lack of alternative payment systems and overbearing, extra-territorial economic prowess of the US has put India in a complicated position. As relations with the US grow, so does the pressure on India to disengage with Iran, while India sees Iran as an essential strategic, energy and counter-terrorism partner. With India poised to grow at more than 7.5 per cent, it needs a stable supply of oil at reasonable prices. India has taken a perspicacious approach to deal with pugnacious regimes as compared to the Chinese stance which foments international and domestic economic unrest. In order to escape international volatility, India needs to gradually put more emphasis on sustainable energy sources rather than oil which forces her to shell out more for the supplies for the refineries and also affect the foreign exchange reserves.

References:

- Dichristopher, T. “Oil rises 1.1% to nearly 6-month high, settling at $66.30, on Trump’s Iran crackdown.” CNBC. April 22, 2019. Accessed June 2, 2019. https://www.vifindia.org/article/2019/june/18/contextualising-the-us-iran-tensions

- The White House Archives. “The Historic Deal that will prevent Iran from acquiring a nuclear weapon.” The White House Archives. June 2, 2019. Accessed June 2. 2019. https://obamawhitehouse.archives.gov/issues/foreign-policy/iran-deal

- The US Department of State. “Foreign Terrorist Organizations.” The US Department of State. July 1, 2019. Accessed July 1, 2019. https://www.vifindia.org/article/2019/june/18/contextualising-the-us-iran-tensions

- RT. “Iranian parliament declares US Central Command a ‘terrorist organization’.” RT. April 17, 2019. Accessed June 1, 2019. https://www.rt.com/news/456772-iran-centcom-terrorist-organization/

- The Times of Israel. “Iran threatens to close Strait of Hormuz after US ends sanction waivers.” April 22, 2019. Accessed June 3, 2019. https://www.timesofisrael.com/iran-threatens-to-close-strait-of-hormuz-after-us-ends-sanction-waivers/

- Wintour, P. “Iran announces partial withdrawal from nuclear deal.” The Guardian. May 8, 2019. Accessed June 1, 2019. https://www.theguardian.com/world/2019/may/07/iran-to-announces-partial-withdrawal-from-nuclear-deal

- Berlinger, J. & George, S. “5 questions about Iran's nuclear deal announcement.” CNN. May 8, 2019. Accessed June 4, 2019. https://edition.cnn.com/2019/05/08/middleeast/iran-us-nuclear-deal-background-intl/index.html

- BBC News. “US sends aircraft carrier and bomber task force to 'warn Iran'.” BBC News. May 6, 2019. Accessed June 1, 2019. https://www.bbc.com/news/world-us-canada-48173357

- Macdonald, M.D., Zerpa, F. & Kim, M. “Scattered Across Globe, PDVSA Roughnecks Wonder About Going Home.” Bloomberg Businessweek. March 15, 2019. Accessed June 12, 2019. https://www.bloomberg.com/news/articles/2019-03-15/scattered-across-globe-pdvsa-roughnecks-wonder-about-going-home

- Reuters. “India says no plans for oil trade with Venezuela using 'petro' cryptocurrency.” Reuters. May 28, 2018. Accessed June 3, 2019. https://in.reuters.com/article/india-venezuela/india-says-no-plans-for-oil-trade-with-venezuela-using-petro-cryptocurrency-idINKCN1IT0ZV

- Iyenger, R. “China buys a lot of Iranian oil, and it's not happy at all with US sanctions.” CNN Business. April 23, 2019. Accessed June 12, 2019. https://edition.cnn.com/2019/04/22/energy/china-iran-oil-us-sanctions/index.html

- Alkhalisi, Z. “Iran is still exporting oil as sanctions deadline passes.” CNN Business. November 6, 2018. Accessed June 3, 2019. https://edition.cnn.com/2018/11/02/business/iran-us-sanctions-oil-exports/index.html

- Mishra, A.R. “How India’s oil economy changed under Modi regime.” Livemint. April 23, 2019. Accessed June 12, 2019. https://www.livemint.com/industry/energy/how-india-s-oil-economy-changed-under-narendra-modi-regime-1555993410291.html

- Fickling, D. “India Should Beware of Saudi Aramco's Billions.” Bloomberg. April 18, 2019. Accessed June 2, 2019. https://www.bloomberg.com/opinion/articles/2019-04-18/aramco-s-bid-for-reliance-refinery-stake-feeds-india-s-oil-habit

- Mohanty, A. “Why Failure of Aramco’s IPO launch is Good News for India?” Vivekananda International Foundation. September 18, 2018. Accessed June 1, 2019. https://www.vifindia.org/article/2018/september/17/why-failure-of-aramco-s-ipo-launch-is-good-news-for-india

- Business Standard. “Iranian Foreign Minister on two-day visit to India.” Business Standard. May 13, 2019. Accessed May 30, 2019. https://www.business-standard.com/article/news-ani/iranian-foreign-minister-on-two-day-visit-to-india-119051301448_1.html

- The Economic Times. “India prepared to deal with impact of end of waivers from US sanctions on import of Iranian oil: MEA.” The Economic Times. May 2, 2019. Accessed May 30. 2019. https://economictimes.indiatimes.com/industry/energy/oil-gas/india-prepared-to-deal-with-impact-of-end-of-waivers-from-us-sanctions-on-import-of-iranian-oil-mea/articleshow/69150548.cms

- Wintour, P. “Saudi oil tankers show 'significant damage' after attack – Riyadh.” The Guardian. May 13, 2019. Accessed June 2, 2019. https://www.theguardian.com/world/2019/may/12/uae-four-merchant-ships-reported-sabotaged

- Kirby, J. “US-Iran standoff: a timeline.” Vox. July 5, 2019. Accessed July 8, 2019. https://www.vox.com/world/2019/6/21/18700857/us-iran-standoff-timeline

- Roche, E. “Iranian foreign minister in India, to discuss US sanctions with Sushma Swaraj.” Livemint. May 13, 2019. Accessed June 14, 2019. https://www.livemint.com/news/world/iranian-foreign-minister-in-india-to-discuss-us-sanctions-with-sushma-swaraj-1557765807580.html

- Reuters. “Iran foreign minister in India for talks after U.S. sanctions.” Reuters. May 14, 2019. Accessed June 13, 2019. https://www.reuters.com/article/us-india-iran/iran-foreign-minister-in-india-for-talks-after-u-s-sanctions-idUSKCN1SK0L5

- US Energy Information Administration. “US Exports to India of Crude Oil.” US Energy Information Administration. June 28, 2019. Accessed July 2, 2019. https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MCREX_NUS-NIN_1&f=M

- Roy, S. “US to India: Helping you on Masood Azhar, so end Iran oil imports.” The Indian Express. April 24, 2019. Accessed June 29, 2019. https://indianexpress.com/article/india/us-to-india-helping-you-on-masood-azhar-so-end-iran-oil-imports-5691315/?fbclid=IwAR3F6pulZF4jMCjDcdzBHgxhNL1bDQ-YhViwEfTCKUtAGWY6SnDJ2jCoGpM

- RT. “Russia welcomes foreign banks to join its money transfer alternative to SWIFT.” RT. October 19, 2018. Accessed June 12, 2019. https://www.rt.com/business/441733-russia-swift-alternative-foreign-banks/

- Aggarwal, P. “How U.S. Sanctions are Fostering Innovative Strategies for Resiliency in Russia.” US-Russia Relations Initiative. October 1, 2018. Accessed June 26, 2019. https://sites.tufts.edu/fletcherrussia/parv-aggarwal-how-u-s-sanctions-are-fostering-innovative-strategies-for-resiliency-in-russia/

- Karpukhin, S. “Stretched String. Is it possible to disconnect Russia from SWIFT.” Forbes. March 15, 2018. Accessed June 2, 2019. https://www.forbes.ru/finansy-i-investicii/358573-natyanutaya-struna-vozmozhno-li-otklyuchenie-rossii-ot-swift

- Financial Tribune. “New Channels for Iran Payments.” Financial Tribune. December 19, 2018. Accessed June 26, 2019. https://financialtribune.com/articles/business-and-markets/95703/new-channels-for-iran-payments

- Choudhary, S. “Rupee payment for Venezuelan oil under consideration.” The Economic Times. March 18, 2019. Accessed June 12, 2019. https://economictimes.indiatimes.com/industry/energy/oil-gas/rupee-payment-for-venezuelan-oil-under-consideration/articleshow/68455762.cms

Image Source: http://pdf.reuters.com/pdfnews/pdfnews.asp?i=43059c3bf0e37541&u=2018-07-16T110235Z_GFXEE7G0UOB7Y_1_RTRGFXG_BASEIMAGE.PNG

Post new comment