At 8:19 PM, on another day of incessant drizzle in Chennai, I clicked on Bloomberg.com only to see the following headlines captioned boldly on the landing page:

Yes, it is somewhat appropriate – whether intended or not – that Bloomberg had focussed on Europe. The world has been watching China more so than ever in the last two years, for all the right reasons. Indeed, even as there is a lot of praise for South Africa for its communication with respect to the new variant, it is hard not to think of the total lack of transparency from the parent country of the virus. The United States, unfortunately, is part of the opacity because of its own involvement with many unsavoury aspects of the virus’ origins. While there is much to discuss on the open questions with respect to not only the origins of the Sars-Cov2 virus but also on the risk of future pandemics, our focus is on Europe in this brief.

In Austria and the Netherlands, there have been reimpositions of lockdowns. The European Central Bank is the most aggressive in expanding balance sheet and it has been at it since Draghi's 'Whatever it takes' statement in 2012. At the same time, even the German annual inflation rate is 4.5% (October 2021). The Eurozone inflation rate is 4.1% (Oct. 2021).

The German Bundesbank nominee on the Eurozone governing council Jens Wiedmann retired from the Bundesbank five years ahead of time. He has clashed with Christine Lagarde the President of the European Central Bank (ECB), on the latter’s monetary policies that have contributed to the resurgence of inflation all over the Eurozone. Germany’s historical aversion to inflation is well-known. That the German Bundesbank is party to a rise in the rate of inflation has been too much to bear and hence he resigned well ahead of his scheduled retirement. His letter to his colleagues in the German Bundesbank reveals the underlying tensions between the ECB’s attitude towards monetary policy and that of the institution he represented.

As a percentage of Eurozone GDP, the ECB balance sheet is 63.5% of GDP and still rising fast. Due to the lack of easy availability of Eurozone nominal GDP data, only the chart of the balance-sheet of the ECB is presented below:

The location of the ECB in Frankfurt was meant to send a signal that it would be a clone of the German Bundesbank. For the first decade of its existence, ECB did live up to that expectation. But, economic growth disappointed in the Eurozone and hence the pressure was on the institution to provide populist answers to concerns over growth and the consequent concern for fiscal stability in several ‘peripheral’ Eurozone members. As a result, the balance sheet of the European Central Bank has expanded massively in the last several years.

Apart from this, in recent months, German Covid infections and deaths have been rising. Daily deaths in Germany have picked up since August. Further, with the formation of the new coalition, German politics has taken a leftward turn in a big way. See this. The Dutch in Rotterdamrioted on Friday for many reasons.

Not to mention the tensions between Belarus and Poland. The border crisis there might pale in comparison to what might emerge in Germany with the new coalitions' liberal immigration policy.

This is important to note:

But while the countries of southern Europe are already accustomed to such activities, almost no one has expected them on the eastern flank of the EU. [Link]

There is a perception that immigrants are being weaponised by Russia and other regimes friendly to Russia to destabilise European democracies. Possible. That is why they are pushing mostly Islamic immigrants into Europe. Integrating all of them is harder. Social tensions will invariably rise.

This article says that the resolute action by the Baltic states, Poland and the EU indicate that no one is contemplating a return to the 'Refugee welcome' policies of 2015-16. That is where the new German coalition's stance becomes important. It might tilt the scales in favour of such a policy all over again and that could lead to internal social tensions in countries on the continent. Not to mention political conflicts.

The migration issue has stirred political conflict and strongly divided public opinion in Lithuania, and in Poland it is likewise creating internal turmoil. [Link]

It is difficult to visualise Germany becoming an immigration society. The societal cohesion will crumble. It won't happen overnight. It will happen over time. By the end of the decade, it will be evident.

Then, there is Turkey. Erdogan who started out in the new millennium as a moderate Islamic conservative with economic reform credentials has turned almost fully authoritarian. His economic policies border on the bizarre.

His prescription of lower financing costs to lower inflation might appear, prima facie, to be reasonable idea but it should be offered as a quiz question to students of economics as lower cost of capital encourages consumption and other forms of spending (residential and non-residential investment, productive and unproductive) such that prices of many goods rise.

In the end, the proof of the pudding must be in the eating. If inflation kept rising, notwithstanding his expectation that lower financing costs would lower the inflation rate or the cost of living, then it is time to admit mistakes and let the central bank reverse course.

Instead, they had doubled down and the Turkish lira had tumbled down. This chart in the FT article published on the 26th November is very revealing:

Turkish lira had depreciated against the dollar every year since 2010 except in 2012.

While this is a risk that many countries face, the risk is particularly acute for Turkey:

Ozlale, whose IYI party has been soaring in the polls and which could form a government with the CHP if the opposition were to win power, says the highly centralised executive presidency put in place by the Turkish leader three years ago is not capable of dealing with the country’s growing problems. “Erdogan is the only decision maker,” he says. “He does not have a good information network. He’s getting older, more tired.” .... Party insiders say some senior advisers in Erdogan’s entourage privately oppose his obsession with cutting rates but are unwilling to tell him. “The president doesn’t like strong people around him. Everyone knows that,” says one government official. “So no one is willing to speak the truth.” [Link]

A Professor from the University of Liverpool writes that the exposure of Spanish banks to Turkey is somewhat higher, one that could go up further if some purchase of a Turkish lender is completed.

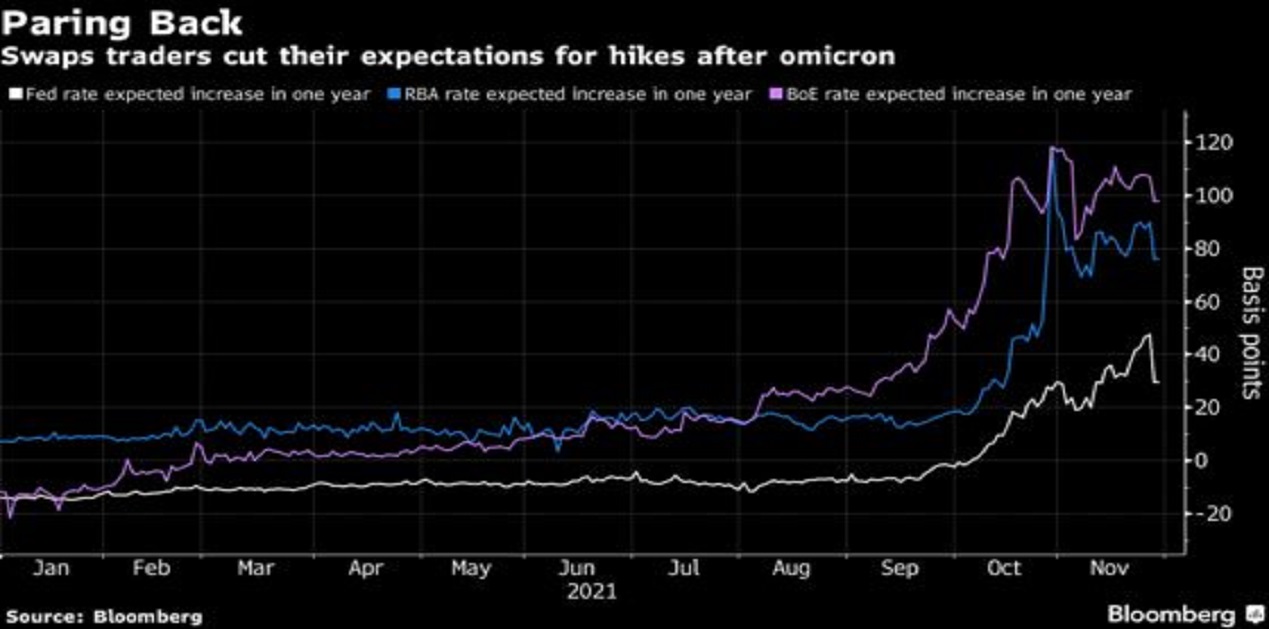

It is amidst this backdrop that the new variant of the virus has made its appearance. These are early days. But, should this provoke nations into further lockdowns, that might be one lockdown too many for the enfeebled economies of Europe, not to mention the discontent and restlessness among the public. Further panic monetary stimulus and or further monetisation of European debt and deficits might prove too much for the Euro to bear. The single currency could very well fracture and split into its component parts.

While there is much focus on China and the United States, the state of affairs in the Eurozone or in Europe, more broadly, is far from reassuring. In fact, it is downright fragile. Should the new variant of the Covid virus proves to be successful in stalling economic activity around the world, the one region that is most vulnerable is the Eurozone and its currency.

It is neither a forecast nor a baseline scenario right now. But, it is a non-trivial risk, nonetheless.

(The paper is the author’s individual scholastic articulation. The author certifies that the article/paper is original in content, unpublished and it has not been submitted for publication/web upload elsewhere, and that the facts and figures quoted are duly referenced, as needed, and are believed to be correct). (The paper does not necessarily represent the organisational stance... More >>

Image Source: https://assets.bwbx.io/images/users/iqjWHBFdfxIU/i5Iy0RTlKVyE/v2/560x-1.png

Post new comment