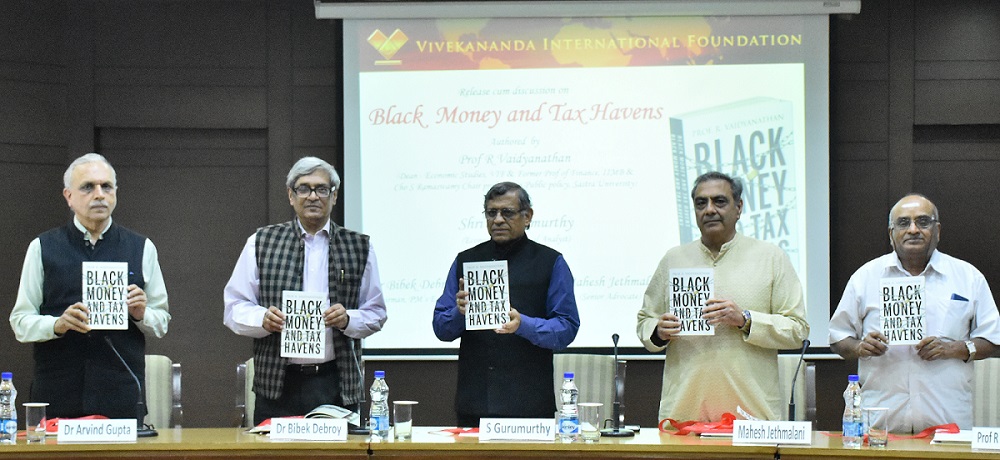

On 3 November 2017, the Vivekananda International Foundation (VIF), New Delhi, hosted the launch of Professor R Vaidyanathan’s latest book titled ‘Black Money and Tax Havens’. Professor R Vaidyanathan is Dean of Centre for Economic Studies at the VIF and a former professor of Finance at the Indian Institute of Management, Bangalore. He is well known for his extensive works on finance, especially in banking, insurance and capital markets. The Book Release saw an intensive discussion among learned panellists including Shri Swaminathan Gurumurthy (a renowned economist and a political analyst), Dr. Bibek Debroy (Chairman, Prime Minister’s Economic Advisory Council) and Shri Mahesh Jethmalani (Senior Advocate).

Shri Gurumurthy correlated the mutually reinforcing relationship between black money and corruption that ails the political and economic sphere in India. He mentioned that the first committee to study black money in India was formed under Shri Ajit Doval (National Security Advisor), Professor R Vaidyanathan and him. He outlined how the 2008 global financial crisis had led the G-20 countries to consider black money as a serious global threat. Dr. Bibek Debroy noted that Indian economy is largely informal and thus cash transactions are obvious. However, despite considerable digitization, the cash to GDP ratio had shot to 13 percent in 2016 from 9 percent in 2000, making it larger than some of other South Asian countries. He also asserted that post demonetization; India saw a marked rise in foreign travel. Dr. Debroy mentioned that Indian government would mark November 8, 2017 as ‘Black Money Day’.

Shri Jethmalani emphasized that lack of legal tools had led to a growing modus operandi in money laundering, especially to tax havens abroad. He stated that demonetization had prominently affected black money inside India, but large amount of the money stashed abroad remained unaudited. He proposed there was great need to pursue stronger international cooperation to get full list of foreign accounts with black money and also at large publish names of tax evaders. Professor R Vaidyanathan stressed the need for effective judicial reforms to deal with black money and discharge swift and effective justice. He underscored the need for severe punishment and the urgent priority of re-establishing confidence in Indian economy.